Friday, March 25, 2011

Thursday, March 24, 2011

Wednesday, March 23, 2011

Some Poker v Trading links for @traderette on twitter

Howard Lederer: On Poker & Trading the Markets http://www.youtube.com/watch?v=qcPD9AmVdl0

Very long detailed article http://www.chrisperruna.com/2010/07/13/trading-and-poker/

Bunch of stuff that says much the same thing...Applying Poker Strategies to Trading The Markets http://www.traderslaboratory.com/forums/f43/applying-poker-strategies-trading-markets-631.html

Ten Lessons I Have Learned About Trading From Poker http://www.traineetrader.com/ten-lessons-i-have-learned-about-trading-from-poker/

Learn Stock Trading From Actively Playing Poker http://www.thebestonlinetrading.info/2011/03/learn-stock-trading-from-actively-playing-poker-2/

Tuesday, March 22, 2011

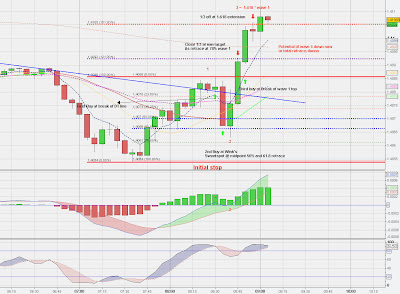

AUDUSD Initial reaction to that 1.618 Extension was purty good...

I'd guess a few other traders were looking at the same idea/place to take profit or short... Bring it home fellahs

AUDUSD Hrly

Now I aint saying for certain sure, as my reads on AUDUSD (bearish) last 2 days have been wrong, but... as per this hourly chart, If the large Red Numbers on Price are correct re wave counts, then wave 3 OFTEN bterminates at the 1.618 extension of wave 1, with price this close and a little weak, potential for entering reasonable shorts to get a 4the wave down capture are getting higher probability and lower risk the closer price gets to the (IGMarkets level) of 1.01

Sunday, March 20, 2011

Saturday, March 19, 2011

view of 2/3rds of hardware hacking room

a bit of a mess at the mo, but here's the reason that I can repair stuff, the main room in my house is devoted to pulling apart sick machines n piecing together well ones... I am strictly an amatuer at this stuff.

ratio of recovery is generally about three dead machines = one good machine... stacked to the gills.

ratio of recovery is generally about three dead machines = one good machine... stacked to the gills.

additional twitter/blogging oriented Station

Thanks to an unexpected find, a 22" monitor for $10.00 at a garage sale, and a thrown out laptop from a while ago, since repaired, I have now got a "side station" to my main trading desk... been kinda planning this for a while since hitting twitter, wanted to keep the two screens on the main station free... so v pleased this has coe together this weekend.

that's the new "twitter n blogging station...

N this is the complete shebang.. still some rough edges n crap wiring to sort, but function is now there

Friday, March 18, 2011

Thursday, March 17, 2011

Quick squizz ar EURUSD

Ultimately I am still looking at the price level of 1.44 as THE high to go for on EURUSD (note IG levels, so relative to spot/futures, not the same) BUT I do notice that potentially 5 waves completing in current uptrend which may see a bit of downside action occurring.. Stochastics are divergent and at this stage a bit early to say but MACD mavs are also, as are the histograms, so cautious to immediate upside.

;)

;)

Quick n dirty Hrly Spi analysis

I reckon that the Hourly uptrend has been confirmed, and we have either done waves 1 to 3 up with a not so easy discern wave 2, or we have done wave 1 up. Note the patterned circled by the blue ellipse on Price, which I dub an "elongated S" which I am used to seeing retracing AT LEAST 50%, and possibly 100%.. which unfortunately the first bit (50%) conforms to a wave 4 possibility and 100 ish percent conforms to a wave 2... so hard to be positive about what is what wave wise at this stage.

Check the stochastics... a drop past oversold would not surprise with that pattern either.

Ultimately I reckon that price has every chance to get up to within the two dotted horizontal blue lines, the 50% and 61% Retrace of the entire drop. If price gets there and how price gets there remains in the hands of the market gods.

;)

Check the stochastics... a drop past oversold would not surprise with that pattern either.

Ultimately I reckon that price has every chance to get up to within the two dotted horizontal blue lines, the 50% and 61% Retrace of the entire drop. If price gets there and how price gets there remains in the hands of the market gods.

;)

Wednesday, March 16, 2011

Tuesday, March 15, 2011

Monday, March 14, 2011

Sunday, March 13, 2011

TadewiJedT rehash

DAX has met some short targets. into fri's 5ddlows & bottom of channel 1. think it will test underside of previous support .around the 7150ish level. SPX made a move on the projected 1313 level already. see the possibility of a nice island reversal on DAX FTSE met the projected 5800, bottom of channel , fri's 5ddlows & looks like ST bottom - maybe test 5900ish? 7150/5900/1313 are the new d-weekly 50% on DAX/FTSE/SPX, respectively. so maybe a good area to reverse - see how it travels. the other thing is there is a fair amount of fear amongst the herd which gives me incentive to look the other way but not entirely. if price goes the other way then i will reorient to those lower brown bear targets - DAX bottom channel 2, 5ddlows & d-weekly/lows around 5900 or 200ma around 5800

Saturday, March 12, 2011

Some days (or nights) are diamonds

Yup I am boasting... you have a prob with that, unfollow me.

Last night was a goody for me, note this was purely scalping play based on wave and momentum reads on 5 min charts... pre market prep, ignoring the doubters, and doing my own thing.

Now if'n ya wanna "dog" these trades, n tell me how they could have been better... show me some live calls like I do and i'll listen otherwise STFU and bow the F down.

GBPUSD

winkinatchaAUS Mar 11, 6:59pm via HootSuite

AUDUSD

winkinatchaAUS Mar 11, 9:18pm via HootSuite

winkinatchaAUS Mar 11, 9:17pm via HootSuite

Last night was a goody for me, note this was purely scalping play based on wave and momentum reads on 5 min charts... pre market prep, ignoring the doubters, and doing my own thing.

Now if'n ya wanna "dog" these trades, n tell me how they could have been better... show me some live calls like I do and i'll listen otherwise STFU and bow the F down.

GBPUSD

winkinatchaAUS Mar 11, 6:59pm via HootSuite

Currently short GBPUSD targetting 1.600 kinda expecting a bounce but short from market open UK... Indices, no position

Profit taken on GBPUSD shorts on hit of 1.600, 50 pips :P

AUDUSD

winkinatchaAUS Mar 11, 9:18pm via HootSuite

have entered longs on AUDUSD

AUDUSD long cooking a bit now here.. here is my view: http://ow.ly/4cnP7

Currrent stat of AUDUSD longs http://ow.ly/4cqk1

Oooooh AUDUSD hit the 1.21 extension, profit taken And taken some off of that quik splort up on DJ... bed time, safe trading all

PS and just for a breif moment... f%^&k I'm good... LOL!

Yerp n AUDUSD has hit my upper target too Hurrah!

DOW

winkinatchaAUS Mar 11, 9:16pm via HootSuite Indices are illing still, but I am very mindful of the spi Discount on cash close tonight, and am looking for legit ways to go long..winkinatchaAUS Mar 11, 9:17pm via HootSuite

78 pwercent retrace of intieal up after euripean open , so bounce here maybe. DAX the strongest

winkinatchaAUS Mar 11, 11:13pm via HootSuite Here's my current view of teh DOW, similar to SPX... http://ow.ly/4cnvh

m'kay I am "expecting" a fairly deep retrace on the 5 min on dow now, looing to see how price reactsabout 15 points below for poss long

Dow n SPX getting down into that 5 min "buy" zone... maybe http://ow.ly/4crgy

Dow so close to teh buy zone now... Looking at Stochs for possible tell (big Brown Arrow) http://ow.ly/4cs1V

Long on DJ after Stoch kick up.. tight stop (prev low) http://ow.ly/4csOH

Friday, March 11, 2011

Looking to add to AUDUSD longs

Don't know if it will let me but i am looking to add to long position if price gets back down to between those dotted blue lines based on the assumption that we are currently in a localised uptrend on the 5 minute, currently in wave 4, from the most recent low... so, wave 1 just above little green arrow, wave 2, next low after, wave 3 topped out at 1.618 extension of wave 1, and wave 4 COULD get down as low as 61.8% of retrace of waves 1 to 3...

price is a pit powerful at the mo tho and since captruing this chart we have bounced from the displayed levels and are retesting wave 3...

darnit

price is a pit powerful at the mo tho and since captruing this chart we have bounced from the displayed levels and are retesting wave 3...

darnit

AUDUSD 5 min chart long

Here's my take on current long on AUDUSD

IF price can get above the local high of the first wave up marked 1 on MACD mavs..

IF price can get above the local high of the first wave up marked 1 on MACD mavs..

DOW JONES on IGMArkets

The DOW hrly has traced out a 3 wave equal measure strructure (so far).. current levels are pretty important and I'd suggest that much lower even if followed by a bounce (say another 100 points lower) suggests that further downside is certain and that means around 11600 ish...

Currently we have 5 discernible tho conjectured waves down, a legitimate time for a bounce if only 50 % of last down leg.

Daily chart shows the current action a little clearer as a 3 wave..

Fib extensions based on first wave down gives a legitmate bounce point if further downside ensues, which would be 'round where I 'd be looking for termination of a wave three, then a wave 4 up, then a 5 getting down possibly to the marked lower trend line

Note I am saying that current action is quite possibly an ABC style correction after a marked 5 wave trend up from July 2010 lows..

Currently we have 5 discernible tho conjectured waves down, a legitimate time for a bounce if only 50 % of last down leg.

Daily chart shows the current action a little clearer as a 3 wave..

Fib extensions based on first wave down gives a legitmate bounce point if further downside ensues, which would be 'round where I 'd be looking for termination of a wave three, then a wave 4 up, then a 5 getting down possibly to the marked lower trend line

Note I am saying that current action is quite possibly an ABC style correction after a marked 5 wave trend up from July 2010 lows..

Wednesday, March 9, 2011

Tuesday, March 8, 2011

Potential downside targets on EURUSD hrly

Hrly chart showing a reasonable head n shoulders, the blue segments are the height of head to neckline...

Used as an equal measure move from recent higher low goves nice confluence with trendline (taken from zoom out). giving a bounce point at around 1.39

Also coincides with a 1.618 fib extension of first down wave

used as calc for eahd and shoulders gives a lower targed around 1.387 also coincides with 200 period moving average on this timespan.

Not I am longer term long oriented on this pair tho may be wrong.

Quick zoom out to show trendline...

Used as an equal measure move from recent higher low goves nice confluence with trendline (taken from zoom out). giving a bounce point at around 1.39

Also coincides with a 1.618 fib extension of first down wave

used as calc for eahd and shoulders gives a lower targed around 1.387 also coincides with 200 period moving average on this timespan.

Not I am longer term long oriented on this pair tho may be wrong.

Quick zoom out to show trendline...

Monday, March 7, 2011

"nicer" long analysis for usdCad

Reason that it's "nicer" for mine is that 5 discerible down waves have completed in the current corrective down move giving weight to this down move being complete

Subscribe to:

Comments (Atom)