(Note IGMarkets chart so price levels may vary from underlying)

Daily

Looking at the last three months daily Price action as a Bearish Pennant formation, a simple uber bearish view.

Not absolutely sure if the "Pole" for the pennant is supposed to be added to the "top" of the pennant or the "bottom" so dotted red arrow shows the "worst Case" scenariom, and filled Arrow shows the lesser worst case.

Note the level confluence between the dotted arrow and the Green dotted (lowest) 1.618 Fib extension of the first wave down.

As marked on the Pennant Break, price has broken and retested the bottom trendline in the last two days action... the Bearish perspective on that is ... downside is very available now.

also on the bearish side, the marked wave counts on the MACD, three discernible waves up and a Failure to break the zero line is a precominantly bearish sign.

Bigger picture view:

the dotted thick dark blue lines represent 50% (near solid second red Arrow head) and 61.8% (near 1.618 extension mentioned above and dotted red arrow head)

Simle bearish View n a few things to suggest it might be true...

;)

Friday, September 23, 2011

Interestingly Similar Patterns

I noticed this similar pattern on two of the instruments I have been analysing n trading recently :

Instrument 1

Instrument 2

Exerpted from different areas in the big picture...

Instrument 1 = Gold Daily

Instrument 2 = Spi 3 Daily

Don't necessary mean a thing but sure would be neat if gold followed what SPI did :)

Instrument 1

Instrument 2

Exerpted from different areas in the big picture...

Instrument 1 = Gold Daily

Instrument 2 = Spi 3 Daily

Don't necessary mean a thing but sure would be neat if gold followed what SPI did :)

Saturday, September 17, 2011

Gold update

Current Hrly chart:

This chart shows gold's decline frrm the high of 6th of September thru to markets close this week.

Rude as it is, I actually went long gold Friday... a few reasons are in the chart.

Reason 1

The marked Fibonnacci retracement combo is based on the first decline from the high, to the first bottom.

During gold price's subsequant travels, the first retrace terminated between teh 61.8 and the 76.4 fib levels.

Fib retraces and subsequant extensions seem to work based on the higher the retrace the lesser the extension.

An extension of 123% of the first leg is shown by the thick dotted light blue line.

This level also coincides with the bottom of the interim channel with the black 5 wave count on price.

Also Very close to the level as marked by the Equal measure move speculation of the Thick red Arrows

So a good target level, and of interest as a potential bounce point

Finally an esoteric Wink MACD MAvs signal showd the long signal occurring as marked by the small green arrow. A plough through significant resistance of the first wave's low and a ride back up to the top of the black channel...

Now Fundamentallybased pureluy on COMEX margin Hikes, I can see more downside as a possibility and significant lower historical gaps (not shown on this chart) also have an attraction about em.

In the meantime thoughthe price action in this most recent decline (marked wave count on price) shows a corrective and (relatively) shallow decline. I am open to further upside at this stage, Possibly only to the top of the lime green marked channel, but Technically I beleive as high as 1860 (on this chart) is valid first.

Esoteric MACD Shizzle...

The manner in which the MACD MAVs have just crossed and bracketed a histogram bar, with the subsequant barr being less suggests to me that this is not a sustainable, new High up move.

There is a similar example of this phenomenon on the First up move in the current chanell..

Future direction, based on this timespan? Guesses guesses guesses. I have closed my long on the black channel hit, I am looking to see what price does around this level with the potential of stall/failure at the limegreen larger channel top, I will wait.

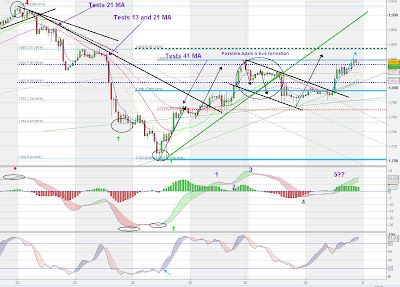

The 4 hr shows some interesting stuff... Firstup Big picture view of the latest uptrend...

FROM an MA on price perspective, Price is riding the declining 41 MA, 21 ma cluster. (pink dotted n currently red solid MAs).

Something of interest to people who may beleive that a MACD moving Average crossover denotes uptrend.. there are two thin vertical lines on the price chart, which coincide with MACD Mav crossovers and Lo n behold, the leftmost was a near high, and the rightmost was a high... this xover thang is NOT (by itself) a signal for commencing an uptrend..s these two examples clearly show, you need the right crossover.

Also of interest, the most recent trendlines on the stochastic.. and the ellipsed bottoming and topping patterns... This latest UP break could well suggest the stochs on this timespan need to get themselves back up to oversold...

In summation...

The recent decline form the top marked as 5 has satisfied (albeit in a smaller timespan) the requirements for a three wave correction after a 5 wave Advance.

the second leg of this declining correction has been more corrective than impulsive and has me hesitant to suggest that further fulls in the NEAR future are likely.

Price is approaching channel tops on the 4 hrly and 1 hrly.. should price break through this channel resistance we may see the start of another impulsive wave up, BUT I will be observing indicator signals in these areas and trendlines on lower timespans in case this is gold's means of shaking off traders before a mre serious decline.

As stated at the top of this post, from a fundamental and Gap perspective i beleive we have significan downside yet to occur... interim Price action is suggesting this downside may be a while off.

This chart shows gold's decline frrm the high of 6th of September thru to markets close this week.

Rude as it is, I actually went long gold Friday... a few reasons are in the chart.

Reason 1

The marked Fibonnacci retracement combo is based on the first decline from the high, to the first bottom.

During gold price's subsequant travels, the first retrace terminated between teh 61.8 and the 76.4 fib levels.

Fib retraces and subsequant extensions seem to work based on the higher the retrace the lesser the extension.

An extension of 123% of the first leg is shown by the thick dotted light blue line.

This level also coincides with the bottom of the interim channel with the black 5 wave count on price.

Also Very close to the level as marked by the Equal measure move speculation of the Thick red Arrows

So a good target level, and of interest as a potential bounce point

Finally an esoteric Wink MACD MAvs signal showd the long signal occurring as marked by the small green arrow. A plough through significant resistance of the first wave's low and a ride back up to the top of the black channel...

Now Fundamentallybased pureluy on COMEX margin Hikes, I can see more downside as a possibility and significant lower historical gaps (not shown on this chart) also have an attraction about em.

In the meantime thoughthe price action in this most recent decline (marked wave count on price) shows a corrective and (relatively) shallow decline. I am open to further upside at this stage, Possibly only to the top of the lime green marked channel, but Technically I beleive as high as 1860 (on this chart) is valid first.

Esoteric MACD Shizzle...

The manner in which the MACD MAVs have just crossed and bracketed a histogram bar, with the subsequant barr being less suggests to me that this is not a sustainable, new High up move.

There is a similar example of this phenomenon on the First up move in the current chanell..

And the middle up move as well... not shown here... Esoteric stuff, not so easily tradeable.

The 4 hr shows some interesting stuff... Firstup Big picture view of the latest uptrend...

FROM an MA on price perspective, Price is riding the declining 41 MA, 21 ma cluster. (pink dotted n currently red solid MAs).

Something of interest to people who may beleive that a MACD moving Average crossover denotes uptrend.. there are two thin vertical lines on the price chart, which coincide with MACD Mav crossovers and Lo n behold, the leftmost was a near high, and the rightmost was a high... this xover thang is NOT (by itself) a signal for commencing an uptrend..s these two examples clearly show, you need the right crossover.

Also of interest, the most recent trendlines on the stochastic.. and the ellipsed bottoming and topping patterns... This latest UP break could well suggest the stochs on this timespan need to get themselves back up to oversold...

In summation...

The recent decline form the top marked as 5 has satisfied (albeit in a smaller timespan) the requirements for a three wave correction after a 5 wave Advance.

the second leg of this declining correction has been more corrective than impulsive and has me hesitant to suggest that further fulls in the NEAR future are likely.

Price is approaching channel tops on the 4 hrly and 1 hrly.. should price break through this channel resistance we may see the start of another impulsive wave up, BUT I will be observing indicator signals in these areas and trendlines on lower timespans in case this is gold's means of shaking off traders before a mre serious decline.

As stated at the top of this post, from a fundamental and Gap perspective i beleive we have significan downside yet to occur... interim Price action is suggesting this downside may be a while off.

Monday, September 12, 2011

SPI Update

Right... last post on SPI Done during market close on the weekend, I was conjecturing UP... At the time I was wrong as we had down for a further day, Up did not come till AUS overnight last night (US Open Session).

A big swathe of my "broader" analysis is based on shizzle I've developed "on my own" over the last 3 years... a combination of MACD and price wave theory.

I feel like a bit of a lone voice in the wilderness with this methodology (Sniff... so Alone) but in my travels through the interwebs, I have come across the odd article or post which touches on the same... I also remember reading Alexander Elder's (or is it the other way around Elder Alexander... apologies if so) book "Come into my trading room" which touches on similar, and Bill Williamson's "trading Chaos" which also touches on similar in greater detail... neverthe less a big portion of what I use I've "developed" in relative isolation from other practitioners of this method, if they exist.

In doing so I am constantly learning n refining stuff about it.

One great insight that I am trying to convert into good trading money is finding the appropriate timespan to find "clean" wave counts n correlation between Price and the MACD Moving Averages (MAVs).

the action on the spi and my weekend conjecture based on lowish timespans is a classic "incorrect" timespan gaffe.

My conjecture was based primarily on the 15 minute chart... vis:

twas a reasonable enough conjecture with conts all apparently neato n stuff, but ultimatel Not quite on the ball, as the action for the day saw a significant new low occur 80 odd points below that shown on this (old) chart...

twas a reasonable enough conjecture with conts all apparently neato n stuff, but ultimatel Not quite on the ball, as the action for the day saw a significant new low occur 80 odd points below that shown on this (old) chart...

I got the HALFWAY mark of the drop on sunday.. LOL!

but anyways the point I wish to make, going back to the timespans thing, is that there was a far bhetter timespan to be looking at, namely the 30 minute....

Much Neater Eh?

;)

A big swathe of my "broader" analysis is based on shizzle I've developed "on my own" over the last 3 years... a combination of MACD and price wave theory.

I feel like a bit of a lone voice in the wilderness with this methodology (Sniff... so Alone) but in my travels through the interwebs, I have come across the odd article or post which touches on the same... I also remember reading Alexander Elder's (or is it the other way around Elder Alexander... apologies if so) book "Come into my trading room" which touches on similar, and Bill Williamson's "trading Chaos" which also touches on similar in greater detail... neverthe less a big portion of what I use I've "developed" in relative isolation from other practitioners of this method, if they exist.

In doing so I am constantly learning n refining stuff about it.

One great insight that I am trying to convert into good trading money is finding the appropriate timespan to find "clean" wave counts n correlation between Price and the MACD Moving Averages (MAVs).

the action on the spi and my weekend conjecture based on lowish timespans is a classic "incorrect" timespan gaffe.

My conjecture was based primarily on the 15 minute chart... vis:

twas a reasonable enough conjecture with conts all apparently neato n stuff, but ultimatel Not quite on the ball, as the action for the day saw a significant new low occur 80 odd points below that shown on this (old) chart...

twas a reasonable enough conjecture with conts all apparently neato n stuff, but ultimatel Not quite on the ball, as the action for the day saw a significant new low occur 80 odd points below that shown on this (old) chart...I got the HALFWAY mark of the drop on sunday.. LOL!

but anyways the point I wish to make, going back to the timespans thing, is that there was a far bhetter timespan to be looking at, namely the 30 minute....

Much Neater Eh?

;)

Gold Update

Gold update...

m'kay First up the hourly:

First up... that Blue Dotted Arrow...

At the time that price was moving in that area I made a comment on twitter that Gold is Acting like it is in a down trend.

Sure enough, price over time confirmed that at least in this timespan it was not just an act, but the statement "acting like it is in a downtrend" prolly needs to be quantified a little...

In a downtrend, price tends to reject levels of resistance, in an uptrend price tends to ignore levels of resistance or punch through.

the trendline resistance was touched as per the wick highlighted by the blue dotted arrow, but there was no follow through, even though price had made a couple of attempts at that area in prvios bars. That shizzle DOES NOT happen in an uptrend... and when that shizzle DOES happen.. by golly it's significant and worth noting.

Be that as it may, looking at the light blue arrows, the levels reached over night (Aussie night that is... US day session for the rest of the world) are fairly significant, price is back down at the 50% level of the previous ( rise that terminated a week ago... plentuy of reasons for a bounce here.

The almost flat latest trendline is the most obvious next bit of resistance for gold to dandle with we'll see how and if it reacts there.

IF the marked red MACD wave count is correct, then a wave 3 bottom is still to come... and if said wave 3 bottom DOES come, then:

A: it should be Lower on Price than Wave 1

B: The MACD Mav's should make a lower bottom than the marked wave 1 on them

I would also EXPECT that this bottom on the MACD Mavs will have a higher low on the MAVS with a lower low on price before entering a conjectured wave 4 up.

I have no position at the moment.

The next post, due in about 15 mins or so will take a bit of a look at timespans (relating to the SPI, a different instrument altogether) and how there will be a "correct" timespan for the MACD v Price wave counts... Why the heck am I saying this? well tis not impossible the hrly is not the "Correct" timespan for clean counts with Gold... we'll see... looks like it is doin fine so far.

;)

m'kay First up the hourly:

First up... that Blue Dotted Arrow...

At the time that price was moving in that area I made a comment on twitter that Gold is Acting like it is in a down trend.

Sure enough, price over time confirmed that at least in this timespan it was not just an act, but the statement "acting like it is in a downtrend" prolly needs to be quantified a little...

In a downtrend, price tends to reject levels of resistance, in an uptrend price tends to ignore levels of resistance or punch through.

the trendline resistance was touched as per the wick highlighted by the blue dotted arrow, but there was no follow through, even though price had made a couple of attempts at that area in prvios bars. That shizzle DOES NOT happen in an uptrend... and when that shizzle DOES happen.. by golly it's significant and worth noting.

Be that as it may, looking at the light blue arrows, the levels reached over night (Aussie night that is... US day session for the rest of the world) are fairly significant, price is back down at the 50% level of the previous ( rise that terminated a week ago... plentuy of reasons for a bounce here.

The almost flat latest trendline is the most obvious next bit of resistance for gold to dandle with we'll see how and if it reacts there.

IF the marked red MACD wave count is correct, then a wave 3 bottom is still to come... and if said wave 3 bottom DOES come, then:

A: it should be Lower on Price than Wave 1

B: The MACD Mav's should make a lower bottom than the marked wave 1 on them

I would also EXPECT that this bottom on the MACD Mavs will have a higher low on the MAVS with a lower low on price before entering a conjectured wave 4 up.

I have no position at the moment.

The next post, due in about 15 mins or so will take a bit of a look at timespans (relating to the SPI, a different instrument altogether) and how there will be a "correct" timespan for the MACD v Price wave counts... Why the heck am I saying this? well tis not impossible the hrly is not the "Correct" timespan for clean counts with Gold... we'll see... looks like it is doin fine so far.

;)

Sunday, September 11, 2011

Some thoughts on the SPI

Right... first up, My "Tape Read" from Friday suggested that monday would see either an open Greater than cash close, OR (recent addition) price reaching the Cash Close SPI value From Friday, sometime during the Monday Day.

Using IGMarket's Aussie 200 Data, ( THIS WILL DIFFER FROM ACTUAL SPI FIGURES but the movements in price remain similar) Cash Close Friday was at 4183... Market close at End of the US Session was at 4100... The potential for an 80+ upday seems a bit unlikely to me at this stage.. If It Occurs, I will be truly gobsmacked.

In the meantime... A quick look at the 15 min chart from a BULLISH (short term) perspective...

This chart is just looking at the downtrend from mid week. MACD Moving Averages are not giving me a good clean wave count to be reflected on price at the moment, so price wavs are a bit of a massive conjecture... the greatest support for such things tho, is that a 1.618 extension of marked wave 1 down gives the dotted Green line and a reasonable area for completion of wave 3... I note that the last little bit of price actionals has given a higher low divergence on the MACD Moving Averages versus thelower low on price... Oft a start of either a wave 4 or wave 1 based on this methodology.... coupled with a break of the (red) 21 ma (yet to be seen if price holds above) and previous tests during the marked wave 3 down of 21 and 41 MAs, this rapid decline HAS satisfied a few requirements along its impulsive decline.

"Tape Read" from US Close suggests SHORT for 8+ points from SPI open... these are short term trades (within the first 20 minutes) and do not give indications for an expected trend for the rest of the day...

From a cynical perspective, 'twould not surprise me to see panic selling on Cash open from those that were long over the weekend, and equally it would not surprise me if the smart money/big boys/Floor trader equivalents were to push price up post the panic selling to rip the hearts out of the non-proffessionals who sold on open, and perhaps suck them into to buying once more...

We shall see eh? :)

Using IGMarket's Aussie 200 Data, ( THIS WILL DIFFER FROM ACTUAL SPI FIGURES but the movements in price remain similar) Cash Close Friday was at 4183... Market close at End of the US Session was at 4100... The potential for an 80+ upday seems a bit unlikely to me at this stage.. If It Occurs, I will be truly gobsmacked.

In the meantime... A quick look at the 15 min chart from a BULLISH (short term) perspective...

This chart is just looking at the downtrend from mid week. MACD Moving Averages are not giving me a good clean wave count to be reflected on price at the moment, so price wavs are a bit of a massive conjecture... the greatest support for such things tho, is that a 1.618 extension of marked wave 1 down gives the dotted Green line and a reasonable area for completion of wave 3... I note that the last little bit of price actionals has given a higher low divergence on the MACD Moving Averages versus thelower low on price... Oft a start of either a wave 4 or wave 1 based on this methodology.... coupled with a break of the (red) 21 ma (yet to be seen if price holds above) and previous tests during the marked wave 3 down of 21 and 41 MAs, this rapid decline HAS satisfied a few requirements along its impulsive decline.

"Tape Read" from US Close suggests SHORT for 8+ points from SPI open... these are short term trades (within the first 20 minutes) and do not give indications for an expected trend for the rest of the day...

From a cynical perspective, 'twould not surprise me to see panic selling on Cash open from those that were long over the weekend, and equally it would not surprise me if the smart money/big boys/Floor trader equivalents were to push price up post the panic selling to rip the hearts out of the non-proffessionals who sold on open, and perhaps suck them into to buying once more...

We shall see eh? :)

Saturday, September 10, 2011

Tech and Ramble on gold

'Kay, for this weekend's Gold Analysis I am going to start off with a 3 hour chart... not cos there is anything magical about the number but because I have been using the 4 hour and lower as working charts and they are full of lines and squiggles, the majority I want left there. By switching to 3, my charting package gives me a clean slate, so I can simplify the view.

3 Hrly

Applying the MACD waves versus price waves, the uptrend from late June, has conformed almost picture perfect and THEORETICALLY has satisfied 5 waves up as marked.

(Wave counts for uptrend In Purple)

Various wave theories suggest 5 waves up are followed by a retrace of minimum 3 waves... EW uses the ABC markings for the retrace and I've emplyed that methodology hare as CONJECTURE that we are entering into a retrace scenario. BUT note as marked by the most recent Green Arrows on lows and highs, in terms of a definition of a down trend, (Lower Highs, Lower lows) we are but POTENTIALLY halfway through fulfilling this definition, One measly lower High marked at the "b" level, so as much as i want to say "Short Gold forever" a bit of caution is probably worthwhile. (I'm still sticking to the short side though :) )

Of INTENSE interest to me is a bit of fundamental news regarding gold... COMEX (supposedly the largest Gold Trading Exchange) has raised Margin Requirements again... from 27% to 40% I gather, effective starting Monday US time.

When was the last time they raised margin requirements? 23rd of August... What happened then? a 10% decline in price over three days... With the new increase, I do wonder what effect that might have. One recent historical event and the result do not a precedent make, but that is well worth thinking about.

In the meantime though, one can see that Gold has some pretty neat resistance and Support via some triangulating trendlines. The downside sets up some nice scenarios, (Height of mouth of triangle being the expected measure of breakout to downside or upside == length of a = length of c)

Switching to the 4hrly working chart...Just showing the last few weeks

Here I've marked out the conljectured c wave.

Note the most recent black trendline shows a break and retest...

Not much more I can say here MACDs are BARELY hinting at a down trend (MAVs below zero line) Stochastic in no mans land.

Green dotted line shows a 1.618 EXTENSION odf marked wave A... don't mena much but if this is to be the start of a serious downtrend then such would be a good target IF we are about to enter or have entered a third wave down. All in all though here we have a "coin toss" situation technically.

A quick look at the hourly, of particular note the marked Red Counts on MACD and Price...

Still a bit of a no mans land according to the MACD and its current like for the zero line.. Stochs suggesting downside... and a lot of indicision.

An interesting week next week no doubt.

;)

3 Hrly

Applying the MACD waves versus price waves, the uptrend from late June, has conformed almost picture perfect and THEORETICALLY has satisfied 5 waves up as marked.

(Wave counts for uptrend In Purple)

Various wave theories suggest 5 waves up are followed by a retrace of minimum 3 waves... EW uses the ABC markings for the retrace and I've emplyed that methodology hare as CONJECTURE that we are entering into a retrace scenario. BUT note as marked by the most recent Green Arrows on lows and highs, in terms of a definition of a down trend, (Lower Highs, Lower lows) we are but POTENTIALLY halfway through fulfilling this definition, One measly lower High marked at the "b" level, so as much as i want to say "Short Gold forever" a bit of caution is probably worthwhile. (I'm still sticking to the short side though :) )

Of INTENSE interest to me is a bit of fundamental news regarding gold... COMEX (supposedly the largest Gold Trading Exchange) has raised Margin Requirements again... from 27% to 40% I gather, effective starting Monday US time.

When was the last time they raised margin requirements? 23rd of August... What happened then? a 10% decline in price over three days... With the new increase, I do wonder what effect that might have. One recent historical event and the result do not a precedent make, but that is well worth thinking about.

In the meantime though, one can see that Gold has some pretty neat resistance and Support via some triangulating trendlines. The downside sets up some nice scenarios, (Height of mouth of triangle being the expected measure of breakout to downside or upside == length of a = length of c)

Switching to the 4hrly working chart...Just showing the last few weeks

Here I've marked out the conljectured c wave.

Note the most recent black trendline shows a break and retest...

Not much more I can say here MACDs are BARELY hinting at a down trend (MAVs below zero line) Stochastic in no mans land.

Green dotted line shows a 1.618 EXTENSION odf marked wave A... don't mena much but if this is to be the start of a serious downtrend then such would be a good target IF we are about to enter or have entered a third wave down. All in all though here we have a "coin toss" situation technically.

A quick look at the hourly, of particular note the marked Red Counts on MACD and Price...

Still a bit of a no mans land according to the MACD and its current like for the zero line.. Stochs suggesting downside... and a lot of indicision.

An interesting week next week no doubt.

;)

Tuesday, September 6, 2011

Gold Tech View

Heh... Coupla days ago I posted up that gold might be at a level that was good for a short... Since then Gold has made a new high (just) so ummm... that was wrong... :)

In that post I showed a 4 hrly chart with price/wave counts on the MACD and promptly went ahead n said I was ignoring them...

I'm not ignoring them now, n here's the (updated) 4 hrly chart again.

I'd like to draw your attention to the Marked wave counts on the MACD in green, and the corresponding purple counts on price.

Now when I dont ignore these counts ( :) ) this up trend has conformed rather well to my relatively esoteric methodology of using the MACD to determine Price waves... whther these Price waves are EW or Gann Waves (just "discovered" these) or wink Waves or wotever the eff... this sure looks neato to me at the moment. Most specifically being the fact that the fifth marked wave is of noticibly less momentum (lower high MACD Mavs wave 5 than MACD wave 3)

Now, in an ideal situation, when these kinda counts occur as neatly as this on a particular timespan, Before a true Change of direction, I would like to see an opposite occurrence to the marked "uptrend coming" at the start of the MACD count... that is, a finishing move that sees a higher high on price with a lower highthan the ellipsed crossover on the MACDs...

Will this occur? NFI... in the meantime tho, I am putting my pencil neck out there AGAIN saying this current up trend is suggesting it's practically done...

In the meantime I'll be watching price's reaction to the latest black up trend line...

Oh n last nights action whipsawed me all over the place.. magnificent to watch but on the lower timespans the sudden change in speed of price messed with my head and I couldn't hold on.

In that post I showed a 4 hrly chart with price/wave counts on the MACD and promptly went ahead n said I was ignoring them...

I'm not ignoring them now, n here's the (updated) 4 hrly chart again.

Now when I dont ignore these counts ( :) ) this up trend has conformed rather well to my relatively esoteric methodology of using the MACD to determine Price waves... whther these Price waves are EW or Gann Waves (just "discovered" these) or wink Waves or wotever the eff... this sure looks neato to me at the moment. Most specifically being the fact that the fifth marked wave is of noticibly less momentum (lower high MACD Mavs wave 5 than MACD wave 3)

Now, in an ideal situation, when these kinda counts occur as neatly as this on a particular timespan, Before a true Change of direction, I would like to see an opposite occurrence to the marked "uptrend coming" at the start of the MACD count... that is, a finishing move that sees a higher high on price with a lower highthan the ellipsed crossover on the MACDs...

Will this occur? NFI... in the meantime tho, I am putting my pencil neck out there AGAIN saying this current up trend is suggesting it's practically done...

In the meantime I'll be watching price's reaction to the latest black up trend line...

Oh n last nights action whipsawed me all over the place.. magnificent to watch but on the lower timespans the sudden change in speed of price messed with my head and I couldn't hold on.

Monday, September 5, 2011

Friday, September 2, 2011

Potential place to short gold

When i say potential I mean potential this is a dicey area n a lot of gold bulls will be singing Hellelujah new tops baby after that wee pop in the last 3 hrs. (which I DID take longs on now closed)

'kay first a look at the hourly:

'kay it's a working chart n so crowded, Plenty of reasons to stay long. BUT that dotted green line, and price's reaction too it is significant.

Based on wave counts marked on MACD and Ssumptin/conjecture equivalent counts on price...

If the MACD wave count is correct in identifying the price wave count, then wave 1 on price is significant.... It can be said that a good price target, after wave one completion for a wave 5 completion is 1.618 times wave 1. That is the dotted green line, based on the supposition that the MACD counts are correctly identifying the Price counts.

so current price level, give or take $5 gold dollars, is a rasonable completion of a trend up, und reverse engineering that is a reasonable place for a reversal on this time span. Now sure, check the various pairs of Equal Measure moves arrow on price, we have plenty of scope for higher based purely on them... but if one considers the previous top (to the left n not shown on this chart) as being a significant top, and that gold MAY be in a still to complete downtrend, with this current uptrend being a RETRACE of a first move down... one cane have an expectation that UPSIDE moves in a downtrend will tend to be truncated to the upside.

I am also mindful of the following working 4 hour chart:

Now on this chart I am more inclined to not take too much stock of the MACD counts marked, Primarily again as I am looking at that first drop as POTENTIALLY being wave 1 of either a three wave or 5 wave DOWN.

The marked sones for sell and buy remain from original analysis that helped bring the initial drop to my attention.

Note the bleu marked Fibb retraces here. we ar testing the 71.8 retrace right now, the MACDS are not convncingly up, the stochastics ar Just in the overbought area, all good places for POTENTIAL RESUMPTION of down trend which could bring price down into the "good buy zone" area.

I am definately not being definitive, n watching the lower timespans for opps for short if they present... Just sayin is all... i don't reckon ANYONE can definitively say uptrend in terms of weeks or Downtrend in terms of weeks at this stage. Coin toss baby... my thoughts though are dside oriented.

'kay first a look at the hourly:

'kay it's a working chart n so crowded, Plenty of reasons to stay long. BUT that dotted green line, and price's reaction too it is significant.

Based on wave counts marked on MACD and Ssumptin/conjecture equivalent counts on price...

If the MACD wave count is correct in identifying the price wave count, then wave 1 on price is significant.... It can be said that a good price target, after wave one completion for a wave 5 completion is 1.618 times wave 1. That is the dotted green line, based on the supposition that the MACD counts are correctly identifying the Price counts.

so current price level, give or take $5 gold dollars, is a rasonable completion of a trend up, und reverse engineering that is a reasonable place for a reversal on this time span. Now sure, check the various pairs of Equal Measure moves arrow on price, we have plenty of scope for higher based purely on them... but if one considers the previous top (to the left n not shown on this chart) as being a significant top, and that gold MAY be in a still to complete downtrend, with this current uptrend being a RETRACE of a first move down... one cane have an expectation that UPSIDE moves in a downtrend will tend to be truncated to the upside.

I am also mindful of the following working 4 hour chart:

Now on this chart I am more inclined to not take too much stock of the MACD counts marked, Primarily again as I am looking at that first drop as POTENTIALLY being wave 1 of either a three wave or 5 wave DOWN.

The marked sones for sell and buy remain from original analysis that helped bring the initial drop to my attention.

Note the bleu marked Fibb retraces here. we ar testing the 71.8 retrace right now, the MACDS are not convncingly up, the stochastics ar Just in the overbought area, all good places for POTENTIAL RESUMPTION of down trend which could bring price down into the "good buy zone" area.

I am definately not being definitive, n watching the lower timespans for opps for short if they present... Just sayin is all... i don't reckon ANYONE can definitively say uptrend in terms of weeks or Downtrend in terms of weeks at this stage. Coin toss baby... my thoughts though are dside oriented.

Wednesday, August 31, 2011

Gold scalp on 5 min... looking for more down, but easing in to market

I think gold is exhibiting signs of preparing for more downside... in the interim I am scalping shorts and loking for opportuinities to add... Entered on break of shown triangle pattern and taken partial profits at completion of pattern target as shown by arrows.

Tuesday, August 30, 2011

Some s_t gold observations

The following Hourly chart is my working chart, and so it is getting a little busy for easy public dissemination. reference back to my twitter blog for as it happened info.

The Adam n Eve formation played out pretty well, and in doing so, a conjectured 50% Retrace of an observed "elongated S" pretty much happened. the red dashed line is the 50% retrace level of that pattern, missed by 5 Gold dollars.

The Black lined channel stood out significantly and gave me the opportunity for a low risk short when price came back to hit the upside... Full advantage of that low risk was taken on that significant break through the top of the conjectured channel, and said short was exited with a small loss.

the old gray matter was not nimble enough to switch to longs so the rest of gold's (Aussie overnight) actionwas left alone. This morning I've had a closer look at the Momentum waves via the MACD as well as price and I See the following.

Currrently price is up at a localised (in the current hrly uptrend) double top level. Marked momentum waves COULD be hinting at a completion of 5 waves upwards (but need the MACD lines to cross over to confirm completion), supported by the stochastics on this time span being back in the Overbought region, again a crossover of THAT indicator required before too much excitement about downside can occur.

ASSUMING that the MACD waves are reflected in price, then a reasonable upside target is the dark green dotted line, a 1.618 extension of the Price level at the top of the momentum wave 1...

All in all though, I am disinclined to take a position either long or short with price at current level...Looking at an even lower timespan of 30 minutes...

Price patterns suggest a toin coss level at the moment, though note the INDICATORS arew suggesting reversal.

As said, not touching this instrument right now... I will let price decide what it wants to do and attempt to ride it when it makes up its mind.

The Adam n Eve formation played out pretty well, and in doing so, a conjectured 50% Retrace of an observed "elongated S" pretty much happened. the red dashed line is the 50% retrace level of that pattern, missed by 5 Gold dollars.

The Black lined channel stood out significantly and gave me the opportunity for a low risk short when price came back to hit the upside... Full advantage of that low risk was taken on that significant break through the top of the conjectured channel, and said short was exited with a small loss.

the old gray matter was not nimble enough to switch to longs so the rest of gold's (Aussie overnight) actionwas left alone. This morning I've had a closer look at the Momentum waves via the MACD as well as price and I See the following.

Currrently price is up at a localised (in the current hrly uptrend) double top level. Marked momentum waves COULD be hinting at a completion of 5 waves upwards (but need the MACD lines to cross over to confirm completion), supported by the stochastics on this time span being back in the Overbought region, again a crossover of THAT indicator required before too much excitement about downside can occur.

ASSUMING that the MACD waves are reflected in price, then a reasonable upside target is the dark green dotted line, a 1.618 extension of the Price level at the top of the momentum wave 1...

All in all though, I am disinclined to take a position either long or short with price at current level...Looking at an even lower timespan of 30 minutes...

Price patterns suggest a toin coss level at the moment, though note the INDICATORS arew suggesting reversal.

As said, not touching this instrument right now... I will let price decide what it wants to do and attempt to ride it when it makes up its mind.

Monday, August 29, 2011

Gold Hourly Followup

Action from the US Session Pretty much followed through from the pre-session analysis...

Hrly Chart:

Tough as it was to do, an Add to the short position on a break of the green trendline came god, with partial profits taken at level of head of second down arrow.

The Red dashed line is 50 percent of the perceived elongated s pattern depicted here (blue segments), and is the "ideal" conservative target based on historical observation of this pattern.

SHOULD price hit that level, there is a high possibility of a good bounce... or... smash through the congestion and make new lows.

Short term price action is suggesting Bounce more likely, with the potential for new highs to come.

Hrly Chart:

Tough as it was to do, an Add to the short position on a break of the green trendline came god, with partial profits taken at level of head of second down arrow.

The Red dashed line is 50 percent of the perceived elongated s pattern depicted here (blue segments), and is the "ideal" conservative target based on historical observation of this pattern.

SHOULD price hit that level, there is a high possibility of a good bounce... or... smash through the congestion and make new lows.

Short term price action is suggesting Bounce more likely, with the potential for new highs to come.

Gold Hrly n 30 min

Gold is being a masive pain to trade right at this moment, with a tight range n no doubt low volume possibly exacerbated while London enjoys a Bank Holiday.

Hrly Chart

Overall I am short oriented on the slightly longer term, seeing the action of the down move 23-25th Aug, as being as yet an incomplete downtrend.

This chart Appears to me to be showing one of them "elongated S" things and current Action COULD be an adam n Eve top on the shown chart, but until that green upsloping trendline breaks, well I Just don't know... Particularly as one can see a buy signal via the MACD moving averages as marked by ellipses n green arrows on Price and the MACD.

If I had my choices, I would also like to see an opposite such signal now... meaning a higher high on price and a lower high on the MACD Mavs.. not there yet.

Arr n just to highlight the "elongated S" thing, (reference from long winded blog), here's the 30 min with it mapped out (badly) using light blue line segments.

The minimum target for shorts here is the congestion around mid point of this pattern round the 1780 price level on this chart...

In the meantime, small possi still open short, most closed due to lack of patience on my part, perhaps a further opportunity to add may arise...

Resulting Price action Shown Here...

Hrly Chart

Overall I am short oriented on the slightly longer term, seeing the action of the down move 23-25th Aug, as being as yet an incomplete downtrend.

This chart Appears to me to be showing one of them "elongated S" things and current Action COULD be an adam n Eve top on the shown chart, but until that green upsloping trendline breaks, well I Just don't know... Particularly as one can see a buy signal via the MACD moving averages as marked by ellipses n green arrows on Price and the MACD.

If I had my choices, I would also like to see an opposite such signal now... meaning a higher high on price and a lower high on the MACD Mavs.. not there yet.

Arr n just to highlight the "elongated S" thing, (reference from long winded blog), here's the 30 min with it mapped out (badly) using light blue line segments.

The minimum target for shorts here is the congestion around mid point of this pattern round the 1780 price level on this chart...

In the meantime, small possi still open short, most closed due to lack of patience on my part, perhaps a further opportunity to add may arise...

Resulting Price action Shown Here...

Saturday, August 27, 2011

Friday, August 26, 2011

Thursday, August 25, 2011

Gold 4hr n 1 hr working charts

hrly

I only see 3 waves Down on this hourly.

Personally I reckon we have another to go on this timespan, but in the meantime the Hrly Buy signal as marked can not be ignored...

i haven't looked much at the lower timespans but I do note, A quick glance at the structure of the latest upsurge on the hrly seems to suggest it has an internal 5 wave structure, so... AND is interacting with the 41 MA at this time... This suggests to me that there is a high possibility price may test the now broken 21 MA (Green/Red) in a corrective 3 wave down fashion... If so how price acts $24 below current will be interesting.

4 Hrly

Stochs are kicking up on this timespan, Again I'm only seeng 2 waves down here n looking for a 3rd with some interaction of Price in the marked "buy zone"

Note that the sell zone was overshot, so may hap the buy will be undershot... Dunno.

I only see 3 waves Down on this hourly.

Personally I reckon we have another to go on this timespan, but in the meantime the Hrly Buy signal as marked can not be ignored...

i haven't looked much at the lower timespans but I do note, A quick glance at the structure of the latest upsurge on the hrly seems to suggest it has an internal 5 wave structure, so... AND is interacting with the 41 MA at this time... This suggests to me that there is a high possibility price may test the now broken 21 MA (Green/Red) in a corrective 3 wave down fashion... If so how price acts $24 below current will be interesting.

4 Hrly

Stochs are kicking up on this timespan, Again I'm only seeng 2 waves down here n looking for a 3rd with some interaction of Price in the marked "buy zone"

Note that the sell zone was overshot, so may hap the buy will be undershot... Dunno.

Tuesday, August 23, 2011

USDCHF Daily with Elongated s?

The channels on this daily chart are from when I was actively trading this pair a while back.. Fibb levels, green horizontal line and crappy attempt at freehand drawing are new... in response to query from @10_cents on twitter

"Elongated S" ref here :

From Winkinatcha Main Blog

"Elongated S" ref here :

From Winkinatcha Main Blog

Counter trend Scalp trading, It aint Rocket science...

Counter intraday trend trading, 5 min chart... using trendline breaks, equal measure moves n Fibbonaccie retrace levels.

Monday, August 22, 2011

Sunday, August 21, 2011

Monday, August 15, 2011

DJIA range pretty much complete on close

Coming up to close on the IGMarkets DJIA equivalent, and price has pretty much completed the Hourly range suggested by price action 5 days ago.

I see the current area as a relatively low risk technical short... based on the scenario that price has commmpeted a 3wave structure or ABC, oft retraced past the point at the start of the wave structure...

that's the negative scenario for price, positive scenario is if we make significan upside from this area in the next day or 3 then more likely in a 5 wave up, which means a deeper retrace later but higher prices post the break out.

/AT THIS STAGE the closing action at least suggests initial shorts AFTER OPEN on the spi.

;)

I see the current area as a relatively low risk technical short... based on the scenario that price has commmpeted a 3wave structure or ABC, oft retraced past the point at the start of the wave structure...

that's the negative scenario for price, positive scenario is if we make significan upside from this area in the next day or 3 then more likely in a 5 wave up, which means a deeper retrace later but higher prices post the break out.

/AT THIS STAGE the closing action at least suggests initial shorts AFTER OPEN on the spi.

;)

Friday, August 12, 2011

Thursday, August 11, 2011

Dow Hrly Next 12hrs conjecture

Personally I think we are still in an uptrend.

Looking for a retrace of around 50% of last US session up, with bbuy potential around that 50% area.

Break down past 61.8% and consider short to y'day lows.

The following chart is that of IGMarkets DowJones equivalent... Price movements are similar to the SPX500, DJIA and e minis.. though actual values will differ.

With a "weak" asian session, SPI (ASX200 (Australian market) ) falling on a Friday, if the close keeps this Fall intact (IE not a massive upspike on close) then odds are in favour based on historical observations, that the overnight market (US day session) will lift the SPI to an opening higher than the Friday close.

Still early afternoon here in Australia , an hour and a half to go before close and the SPI is dropping still.

Looking for a retrace of around 50% of last US session up, with bbuy potential around that 50% area.

Break down past 61.8% and consider short to y'day lows.

The following chart is that of IGMarkets DowJones equivalent... Price movements are similar to the SPX500, DJIA and e minis.. though actual values will differ.

With a "weak" asian session, SPI (ASX200 (Australian market) ) falling on a Friday, if the close keeps this Fall intact (IE not a massive upspike on close) then odds are in favour based on historical observations, that the overnight market (US day session) will lift the SPI to an opening higher than the Friday close.

Still early afternoon here in Australia , an hour and a half to go before close and the SPI is dropping still.

DOW update

Confession... I have no idea... this is just intellectual conjecture while I wait for the market to give me something to grab...

Esoteric wink stuff caution

This will be post the fact once it gets up on twitter but... two things,,,

The rise just now on dow came up from a "not quite" macd buy signal.

The MACD mavs have bracketed a bar (as highlighted by arrow) which suggests that price should get below the latest green candle.

If it does it will break the uptrend line black

And that is a fairly legit short signal.

The rise just now on dow came up from a "not quite" macd buy signal.

The MACD mavs have bracketed a bar (as highlighted by arrow) which suggests that price should get below the latest green candle.

If it does it will break the uptrend line black

And that is a fairly legit short signal.

Wednesday, August 10, 2011

Subscribe to:

Comments (Atom)